Gross pay calculator hourly

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. You can choose whichever form is most convenient for you be it the hourly weekly monthly or annual rate and the rest will be converted automatically.

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

To calculate your net salary you will need to subtract federal and local income taxes as well as other deductions.

. Your gross pay will be automatically computed as you key in your entries. Please note that these calculations are based on the 202223 NHS payrise announced in July 2022. Hourly Rate Bi-Weekly Gross HoursYear Calculating Premium Rates.

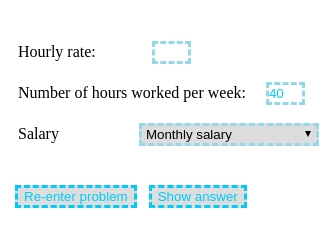

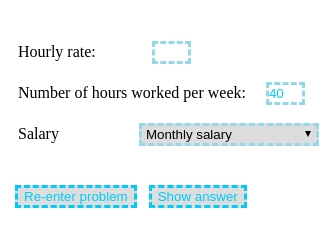

Then enter the number of hours worked and the employees hourly rate. An hourly or nonexempt employee is paid by the hours worked times the agreed-upon hourly. Enter the raise percentage raise amount or new pay.

For premium rate Time and One-Half multiply your hourly rate by 15. You can use our simple calculator below to quickly calculate retroactive pay for hourly employees salaried employees and even for flat rate amounts. It determines the amount of gross wages before taxes and deductions that are withheld given a specific.

Calculations have been updated to reflect the additional 202223 National Insurance contributions and changes in Pension contributions from October. For example if you earn 2000week your annual. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

In this case well use the hourly employee from Table 1 whose gross pay for the week was 695. Once you fill in one of those fields the pay raise calculator will output all. Depending on the information you provide the Pay Rate Calculator computes different information.

Net weekly income Hours of work per week Net hourly wage. Hourly Paycheck Calculator quickly generates hourly net pay also called take-home pay free for every pay period for hourly employees. Calculate your Pay rise New Pay using our Pay raise Calculator Current Pay.

Prior Period Hourly Pay Rate Expected. NHS Hourly Pay 202223 including NI The table below lists the NHS Band salary gross and net hourly rates amount per hour. To try it out enter the workers details in the payroll calculator and select the hourly pay rate option.

Start with the employees gross pay. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. 27 overtime pay rate x three hours paid incorrectly 81 gross retro pay due.

Then use the employees Form W-4 to fill in their state and. Net annual salary Weeks of work per year Net weekly income. Input additional payments like overtime bonuses or commissions.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Skip To The Main Content. If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours.

The salary numbers on this page assume a gross or before tax salary. Enter the pay before the raise into the calculator. Gross annual income - Taxes - CPP - EI Net annual salary.

Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. Employers must provide an employee with 24 hours written notice before a wage change. Use this simple payrise calculator to calculate your new net income after a payrise and get all the details of hourly weekly monthly semi-monthly and annual conversions automatically.

This calculator is based on 2022 Ontario taxes. Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweekIssuing comp time in place of overtime pay is not allowed for non-exempt employees. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Fill the weeks and hours sections as desired to get your personnal net income. To determine net pay gross pay is computed based on how an employee is classified by the organization. Retro Pay Calculator - Hourly.

Net salary calculator from annual gross income in Ontario 2022. For instance for Hourly Rate 2600 the Premium Rate at Time and One. Employers are required provided certain conditions are.

Hourly rate calculated from annual salary How do I calculate my take-home pay after income taxes. If this employee had zero deductions their gross pay and net pay would be the same. Switch to salary calculator.

Other gross pay contributors. Use this federal gross pay calculator to gross up wages based on net pay. This is where the deductions begin.

If you already know your gross pay you can enter it directly into the Gross pay entry field. This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022. Start by subtracting any pre-tax deductions offered by the business.

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator Convert Hourly Wage To A Salary

Hours Wage Calculator Cheap Sale 58 Off Www Wtashows Com

Calculating Income Hourly Wage Youtube

Hourly Paycheck Calculator Hot Sale 51 Off Www Wtashows Com

Hours Pay Calculator Cheap Sale 52 Off Www Wtashows Com

Monthly Salary Calculator Top Sellers 58 Off Www Wtashows Com

Gross Pay And Net Pay What S The Difference Paycheckcity

Salary To Hourly Calculator Hot Sale 52 Off Www Wtashows Com

How To Calculate Gross Pay Youtube

How To Calculate Payroll For Hourly Employees Sling

Salary To Hourly Calculator Online 59 Off Www Wtashows Com

Hours Pay Calculator Sale Online 55 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube